Artificial Intelligence (AI) has become a disruptive force in a lot of industries. Its ability to simulate thinking and learning like humans means that it has been created with the ability to analyze data, recognize patterns, and make predictions based on available information. In a lot of ways, it has begun to outperform humans at simple and repetitive tasks, and may even develop enough to completely remove the need for manual labor in certain jobs. One of the industries that surprisingly stands much to gain from the new reigning influence of AI is the healthcare insurance industry and their claims submission process.

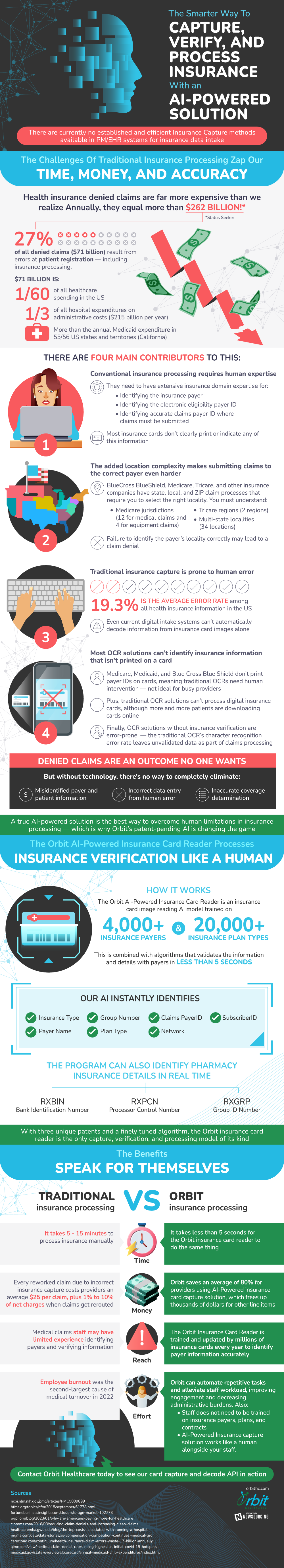

Right now, the traditional claims submission process is extremely costly and time consuming, even though a large proportion of claims go on to be denied. Claims that are denied cost an astounding $262 billion a year. 27%, or $71 billion of this amount is due to the first stage in the process, which is the patient registration phase. This means that simple errors, such as entering a patient's information wrong or selecting the wrong payerID can lead to an outright claim denial, even if it otherwise would've been approved. This is a huge waste of financial resources, equivalent to one-third of annual hospital administration costs and 1/60 of all healthcare spending in the United States. This is why an AI powered insurance card capture solution is so important.

There are a few main drivers behind this high error rate. One of the main reasons is that a lot of insurance processing relies upon human expertise. These employees must be able to locate and identify some vital bits of information, including the insurance payer, the electronic eligibility payer ID, and where the claims must be submitted. Most insurance cards don't clearly print or indicate this information, so it is up to the employee to find out what to enter or run the risk of having the claim denied. Unfortunately, this is a very real outcome- on average, there is a 19.3% human error rate among all health insurance information in the United States.

The current system doesn't always make it easy to submit the right information either. One of the most difficult pieces to get approved is the correct locality for the insurance company. BlueCross BlueShield, Medicare, and Tricare, among other insurance providers, have strict requirements for each state, local, and ZIP claim process. This means that selecting the right locality is imperative to make sure the claim doesn't get denied. There is a lot to keep track of though. There are 12 medical and four equipment claim jurisdictions for Medicare, two Tricare regions, and 34 multi-state localities across the United States.

On top of how difficult it can be to manually keep track of information, the current digital intake systems struggle to do a perfect job. The optical character recognition systems (OCR) are designed to convert documents into data just by scanning them. They usually work with insurance cards, but unfortunately most insurance cards do not carry the information that the insurance processors need, such as PayerID. This means that human intervention is necessary to carry out the process effectively, but this slows down the information gathering process significantly. OCRs also can't process digital insurance cards yet, even as they are becoming more and more popular with patients.

Without new technology, there might continue to be misidentified patient and payer information, rampant human error, and inaccurate coverage determination in the healthcare insurance industry. Thankfully, AI might be what saves it from complete obsoletion. The AI software first becomes trained on huge datasets made up of 20,000 different insurance plan types and 4,000+ insurance payers to become adept at validating information quickly. In fact, some of these AI solutions can identify and validate data in as little as five seconds, ranging from payer name to insurance type to claims payerID. This is a massive improvement from traditional insurance processing, which takes 5-15 minutes when processed manually.

In conclusion, the integration of AI technologies seems to hold great promise for the insurance claims sector. It has the ability to tackle the underlying issues of efficiency, accuracy, and antiquated technologies. This might result in significant cost savings and a more efficient, error-free system. The secret to achieving these game-changing advantages lies in the industry's decision to adopt and advance AI-driven solutions.